Washington state sales tax is a location based tax. Where ever you accept the money, contract or perform the business is the tax jurisdiction you will use to charge sales tax. This can be confusing with a mobile business like construction, grooming, or other specialized services categorized as retail services with the Department of Revenue. And, to add to the confusion may be the fact that tax rates can change, or that a large city like Seattle will have more than one tax code. How do you keep track? If you’re wrong, you have either over or under taxed (usually under) and that comes out of your profit.

Fortunately, thanks to today’s technology, the state has provided a solution to this problem in an easy-to-use app for your phone. Unfortunately, it is barely mentioned on the Washington State Dept. of Revenue website, and no one ever talks about it. I’ve searched YouTube and all over the internet…not even a mention. Hard to believe considering the value of this amazing tool that is offered for free. Here’s the link: https://dor.wa.gov/taxes-rates/sales-use-tax-rates/tax-rate-lookup-app

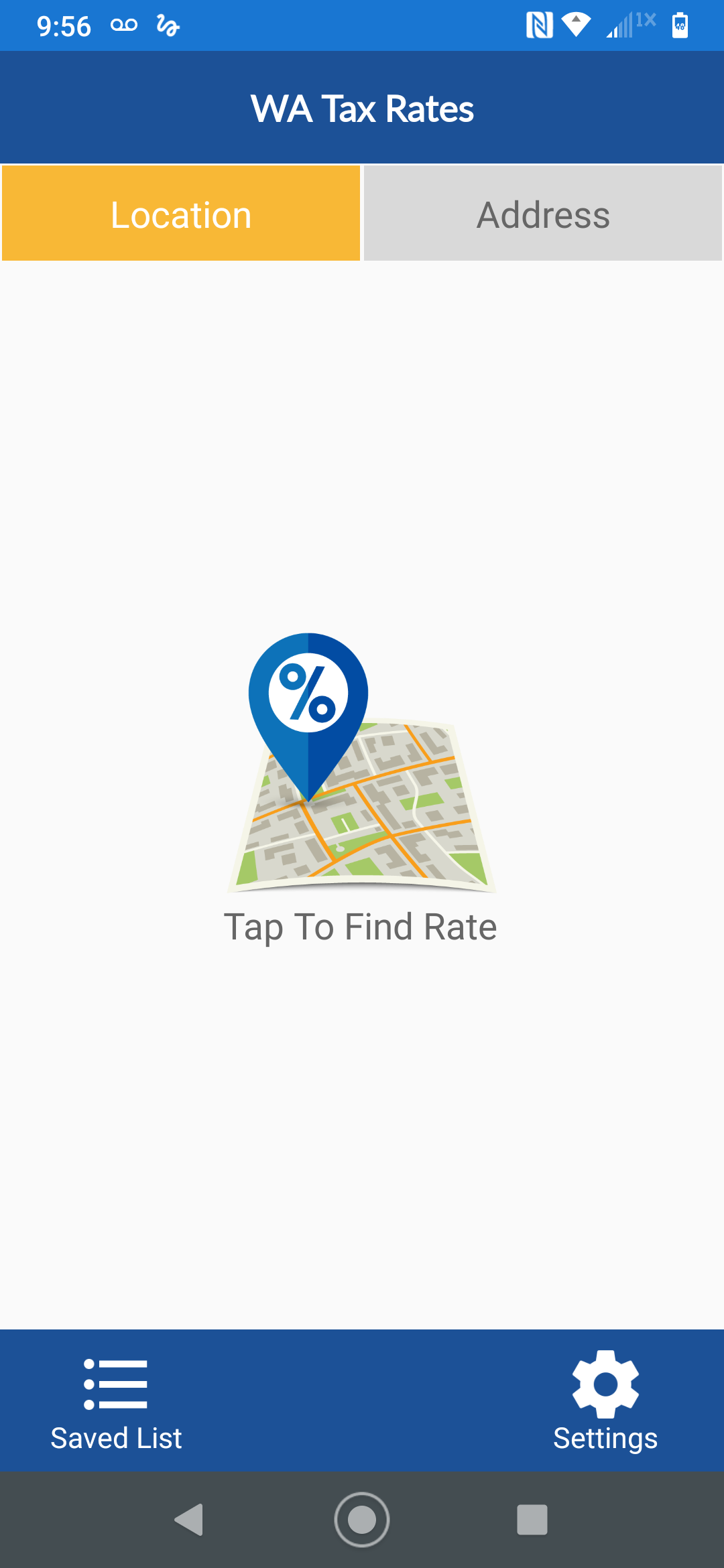

This is what the app looks like when you first open it. If you allow, it ties into the maps function on your phone. As long as you have cell service, the app will tell you exactly what your rate is right where you’re doing business. If you are not at the location, but you are talking to a customer about possible charges, you can type in the address manually.

This is what the app looks like when you first open it. If you allow, it ties into the maps function on your phone. As long as you have cell service, the app will tell you exactly what your rate is right where you’re doing business. If you are not at the location, but you are talking to a customer about possible charges, you can type in the address manually.

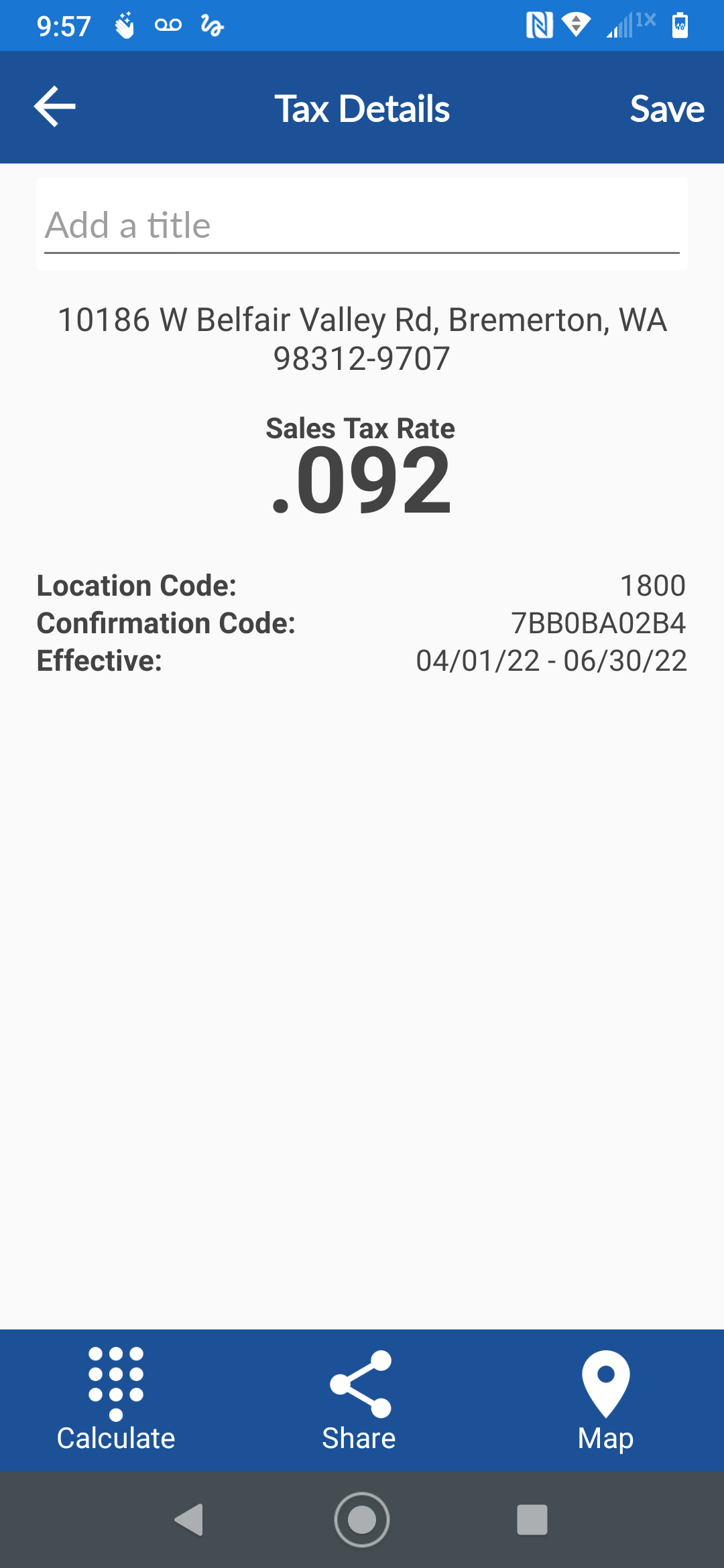

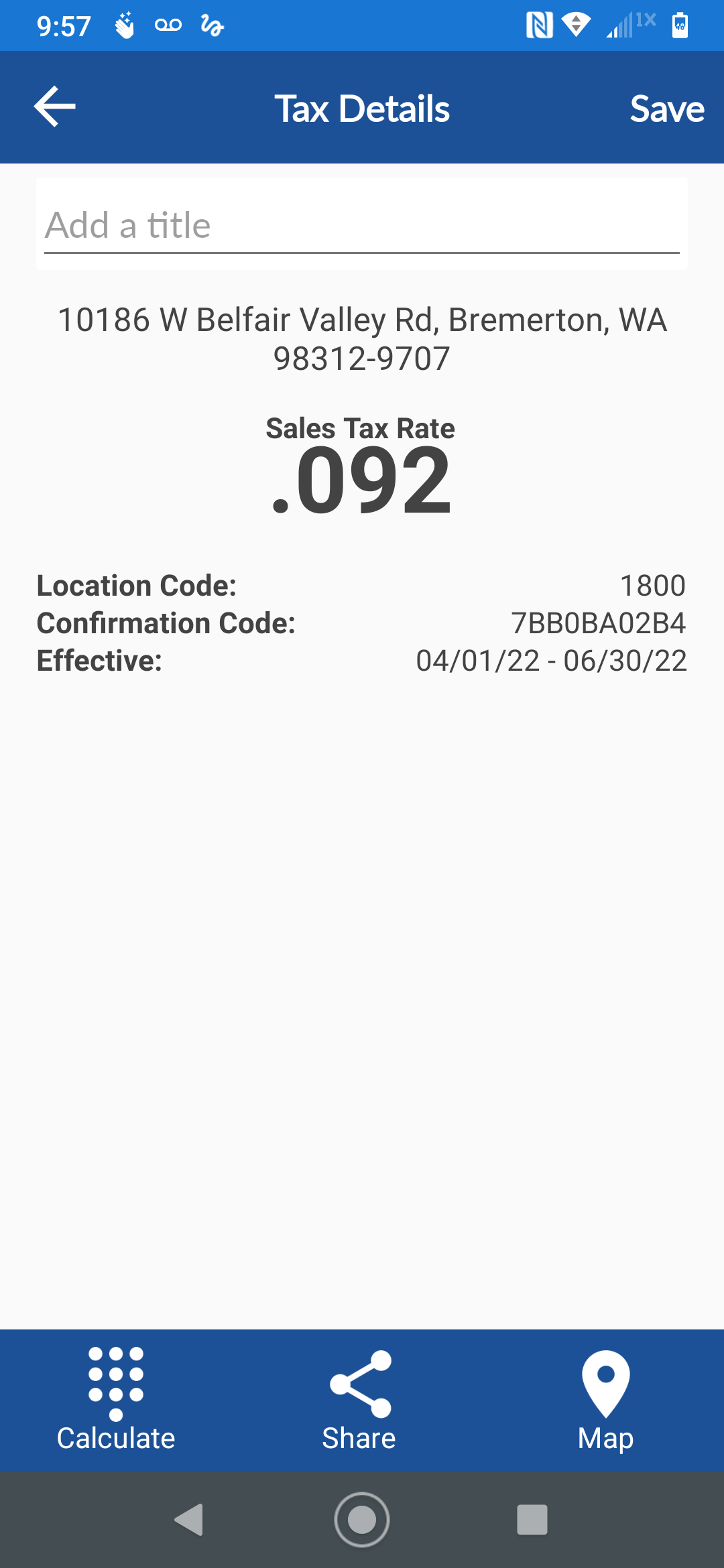

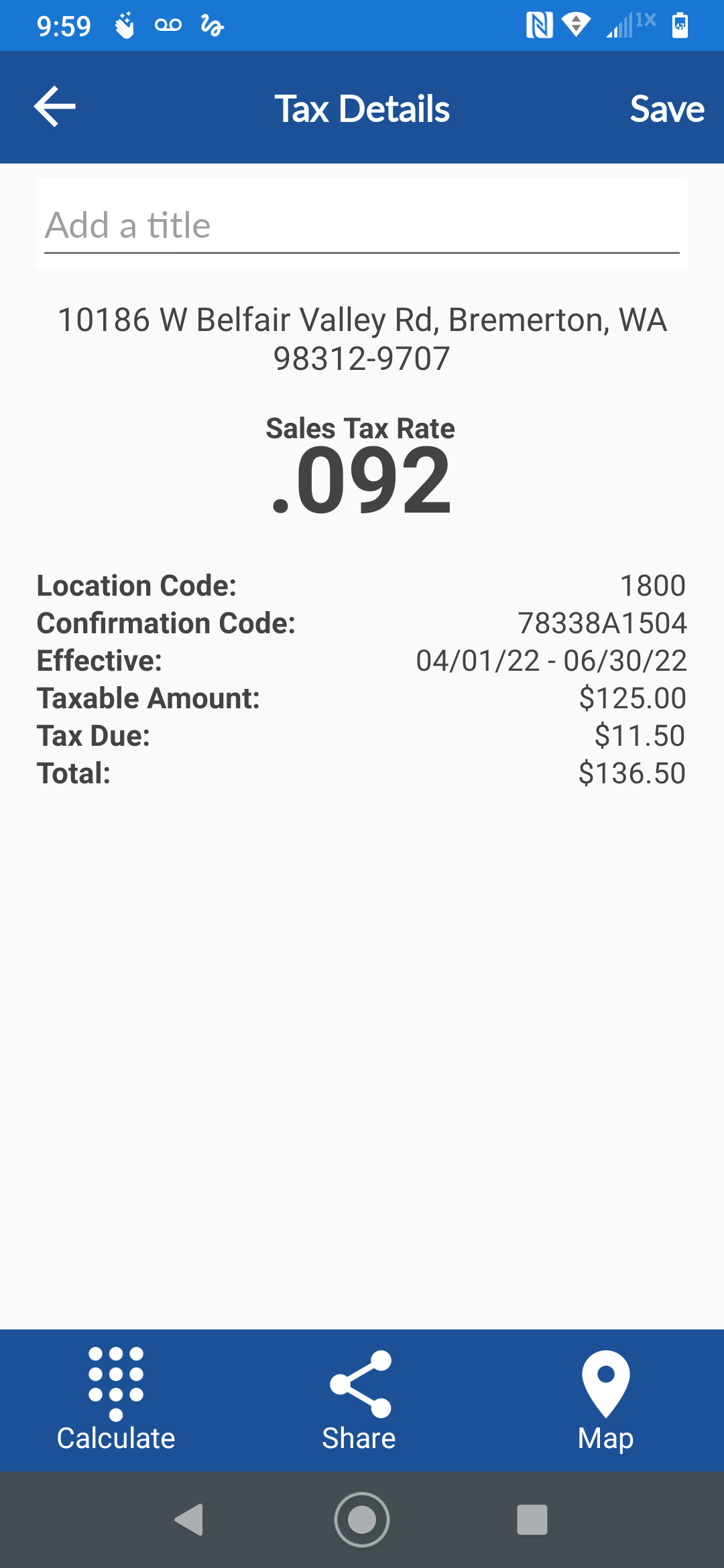

The app not only tells you your rate, but it also tells you the location code, which is vital for reporting your sales tax on your Dept. of Revenue Excise Tax Return. As you can see on the bottom of the screen, you can calculate an amount with sales tax, you can also share via email your location rate or see the map image of the rate.

The app not only tells you your rate, but it also tells you the location code, which is vital for reporting your sales tax on your Dept. of Revenue Excise Tax Return. As you can see on the bottom of the screen, you can calculate an amount with sales tax, you can also share via email your location rate or see the map image of the rate.

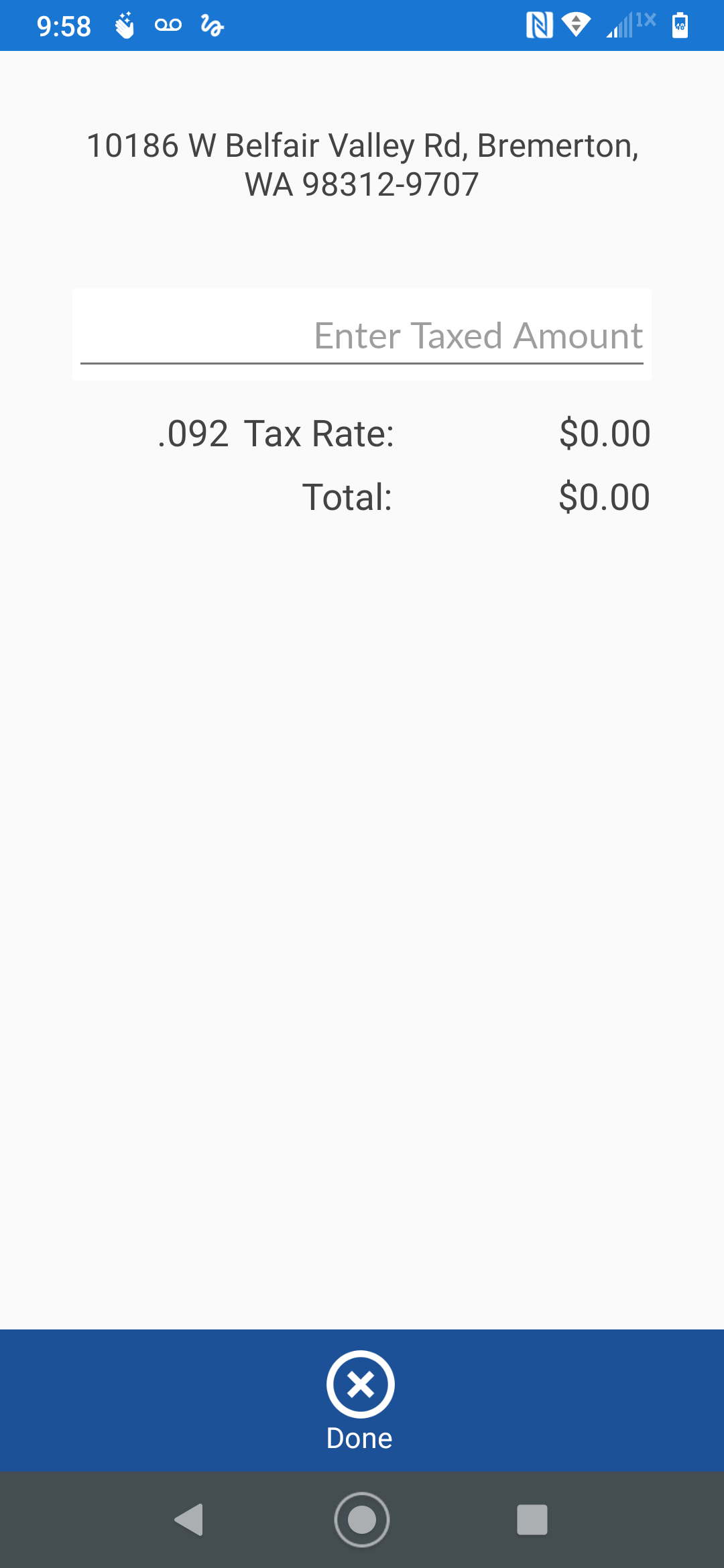

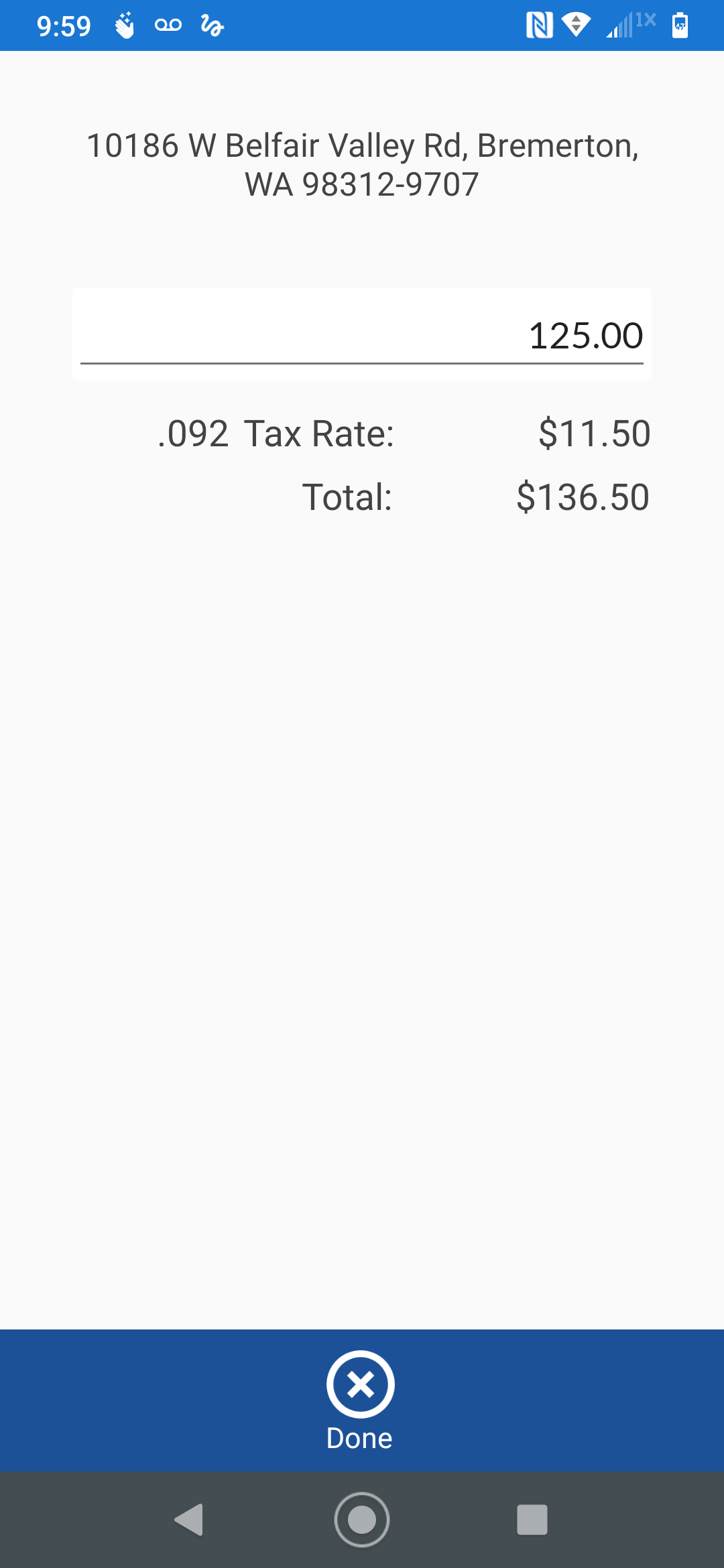

Here, in two images, I’ve gone to the calculate page and typed in $125.00. As you can see, the app automatically calculated the taxes based on my location and added it to my amount. I can now give a quote to my customer on the fly.

Here, in two images, I’ve gone to the calculate page and typed in $125.00. As you can see, the app automatically calculated the taxes based on my location and added it to my amount. I can now give a quote to my customer on the fly.

When I hit, “Done”, I can add a title to my search, save it for future reference, and also share it with the office so it can be logged in by office personnel. No writing notes or guesswork required.

When I hit, “Done”, I can add a title to my search, save it for future reference, and also share it with the office so it can be logged in by office personnel. No writing notes or guesswork required.

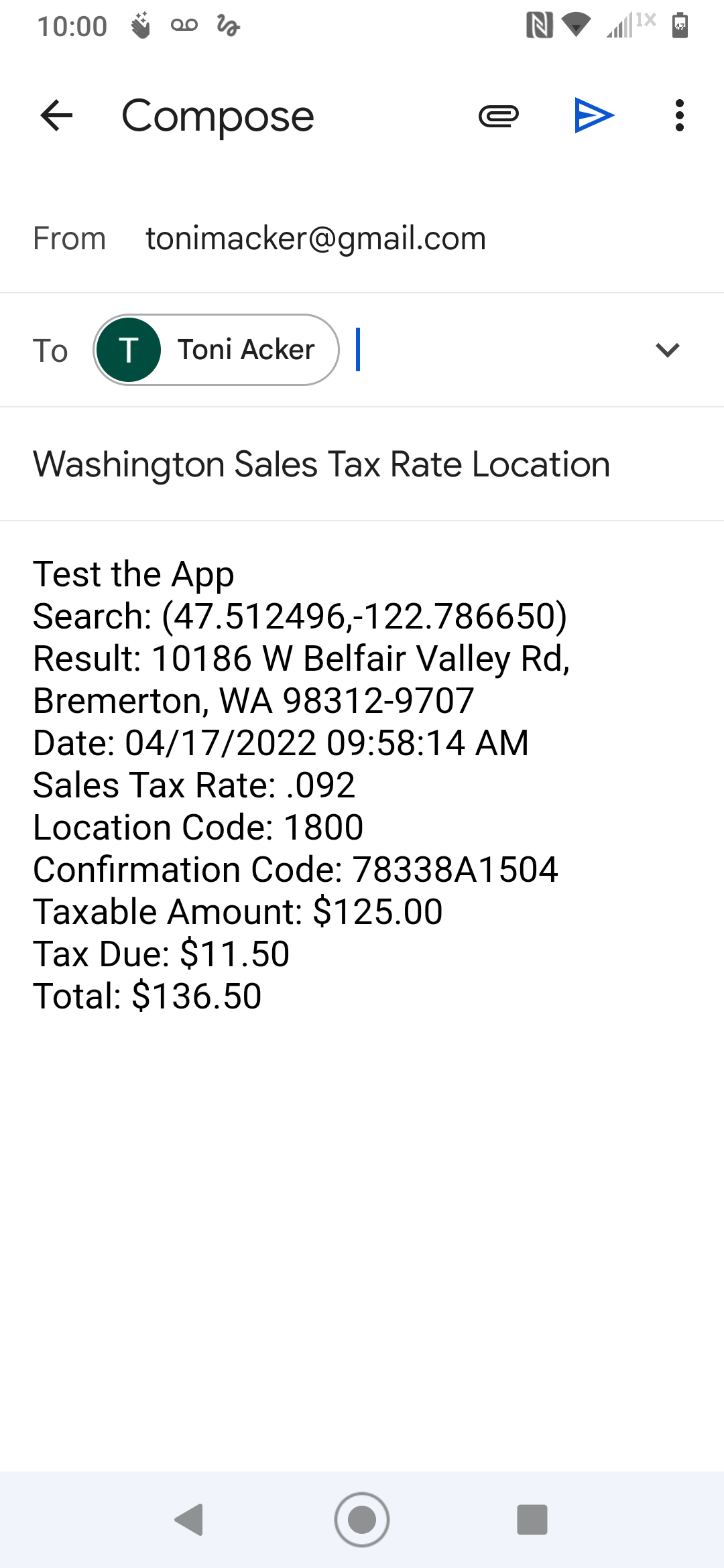

Here you can see I have titled my search “Test the App”. When I hit “share” my search went to email so I can send it anywhere. The email includes the address of my customer/job, the date I made the quote, the sales tax rate, the location code and the amount I quoted the customer with the sales tax included. It also provided a confirmation code from the state that backs my numbers in the event of audit.

Here you can see I have titled my search “Test the App”. When I hit “share” my search went to email so I can send it anywhere. The email includes the address of my customer/job, the date I made the quote, the sales tax rate, the location code and the amount I quoted the customer with the sales tax included. It also provided a confirmation code from the state that backs my numbers in the event of audit.

If I save my search, it stays on my phone for future reference. I can export my saved list to excel, share the list with my office, or clean up the list when I’m done.

If I save my search, it stays on my phone for future reference. I can export my saved list to excel, share the list with my office, or clean up the list when I’m done.

All in all, I think this is probably the most valuable tool you can have when it comes to your business. If you have a mobile business where you offer pricing on the go, this will take away guess work and increase profit. If you quote $10,000, now you can call out the 10% tax rate on the spot and include it in the quote, instead of only keep 90% of $10,000 and give the rest toward taxes.

We all do our part to help the state provide valuable services to our community, but there’s no reason it has to hurt. The state provides us with valuable tools to help our business thrive, but it’s up to us to use them.

Toni